If you’re considering investing in gold coins and have your eye on those shiny Malaysian beauties, you may be wondering if there are any restrictions on exporting them. Well, good news! In this article, we’ll explore whether Malaysia imposes any limitations on exporting gold coins, so you can make informed decisions about your precious metal investments. So, let’s dig in and find out if you can take those gleaming gold coins home with you hassle-free!

Introduction

If you’re a gold investor based in Malaysia, you might be wondering about the regulations surrounding the export of gold coins. It’s essential to have a clear understanding of these regulations to ensure a smooth and legal process. In this article, we will provide you with an overview of gold coins in Malaysia, discuss the export regulations imposed by the government, explore the implications for gold investors, and explore alternative options for exchanging gold coins. We’ll also touch upon import regulations in destination countries and considerations for antique and collectible coins. So, let’s dive in!

Overview of Gold Coins in Malaysia

Types of Gold Coins

Gold coins come in various forms and denominations. In Malaysia, you can find both local and international gold coins. Local options include the Kijang Emas, produced by Bank Negara Malaysia, and other coins supplied by reputable local banks and dealers. International gold coins such as the Canadian Maple Leaf and the American Eagle are also popular among Malaysian investors.

Popularity of Gold Coins

Gold coins have gained significant popularity among investors in Malaysia. They offer a convenient way to invest in gold due to their smaller size, making them easily tradeable and manageable. Additionally, gold coins are often preferred by collectors and enthusiasts for their aesthetic appeal and historical significance.

Value and Importance of Gold Coins

Gold coins hold both intrinsic and investment value. Intrinsic value refers to the actual gold content of the coin, while investment value encompasses factors such as rarity, scarcity, and historical significance. Gold coins serve as a store of value and a hedge against inflation, making them a valuable addition to an investment portfolio.

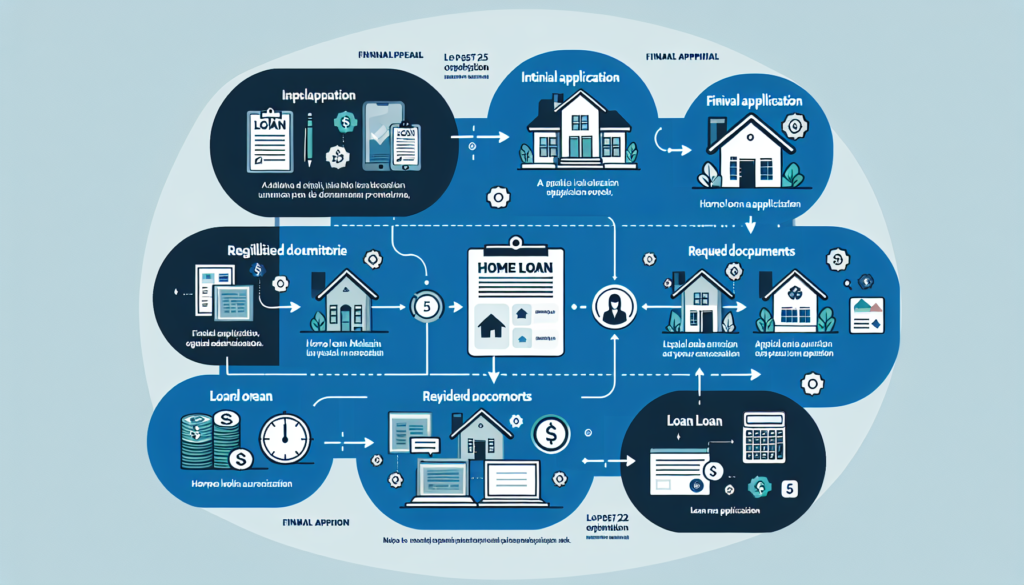

export gold coins from Malaysia

Export Regulations for Gold Coins

Government Policy on Gold Coin Export

The Malaysian government allows the export of gold coins but imposes certain restrictions and guidelines to ensure the proper regulation of the market. These regulations aim to maintain the stability of the country’s gold supply and prevent illicit activities.

Export License Requirements

To export gold coins from Malaysia, you will need to obtain an export license from relevant authorities. This license serves as a permit and ensures compliance with the government’s regulations. It is essential to obtain the necessary documentation and fulfill all requirements before proceeding with the export process.

Documentation and Reporting

When exporting gold coins, proper documentation is crucial. You will need to provide detailed records of the gold coins, including their weight, purity, and value. Additionally, you may be required to report the export transaction to the relevant authorities for transparency and regulatory purposes.

Regulations for Antique and Collectible Coins

Antique and collectible coins often have unique regulations compared to investment gold coins. If you are exporting antique or collectible gold coins, it is essential to research specific regulations and requirements. These coins may have additional documentation and certification requirements due to their historical or cultural significance.

Implications for Gold Investors

Impact on Investment Opportunities

Export regulations can impact the investment opportunities available to gold investors. These regulations may limit the options for diversifying one’s portfolio, especially if certain gold coins are restricted or require extensive documentation for export. Investors need to stay updated and understand the implications of these regulations on their investment strategies.

Potential for Profit

Exporting gold coins can offer a potential for profit. By taking advantage of price differences in different markets, investors may be able to sell gold coins at a higher price overseas. However, it’s crucial to carefully assess the market conditions and consider various factors before pursuing export for profit.

Factors to Consider before Exporting Gold Coins

Before exporting gold coins, there are several factors you should consider. These include market demand and prices in the destination country, potential costs and risks associated with the export process, and compliance with both Malaysian and foreign regulations. Thorough research and consultation with experts are recommended to make informed decisions.

restrictions of gold coin export

Customs Procedures and Restrictions

Customs Declarations

When exporting gold coins, it is vital to adhere to the customs procedures and regulations of both Malaysia and the destination country. This includes accurately declaring the gold coins and providing the necessary documentation to customs officials. Failure to comply with customs declarations can result in delays, penalties, or even confiscation of the coins.

Currency Reporting Requirements

In addition to customs declarations, some countries may have specific currency reporting requirements. If you are carrying a significant amount of gold coins or their value exceeds a certain threshold, you may need to declare them to the customs authorities. Familiarize yourself with the destination country’s regulations to ensure a smooth customs process.

Carrying Gold Coins during Travel

If you plan to carry gold coins with you during travel, it is essential to be aware of the restrictions and regulations imposed by both Malaysia and the destination country. It is advisable to keep the gold coins securely stored, declare them if required, and carry any necessary documentation to avoid any legal complications.

Repercussions of Violating Export Regulations

Legal Penalties

Violating export regulations can have severe legal repercussions. Depending on the nature and severity of the violation, individuals involved may face fines, imprisonment, or other penalties as prescribed by Malaysian law. It is crucial to comply with all export regulations to avoid legal consequences.

Confiscation of Gold Coins

Non-compliance with export regulations may lead to the confiscation of gold coins by the authorities. Such instances can result in significant financial losses and the loss of valuable investment assets. Adhering to the export regulations ensures the protection of your gold coins and investments.

Impact on Reputation and Future Transactions

Violating export regulations can also have long-term consequences, including damage to one’s reputation as an investor. Non-compliance may hinder future business opportunities, limit access to certain markets, and create difficulties in establishing trust with potential partners or buyers. Upholding ethical practices and abiding by regulations is vital for maintaining a positive image and ensuring continued success in the gold investment industry.

Alternative Options for Exchanging Gold Coins

Selling Gold Coins Locally

If the export regulations are too restrictive or complicated, selling gold coins locally can be an alternative option. Many local banks, dealers, and jewelry shops in Malaysia offer services to buy back gold coins at competitive prices. Researching and comparing different options can help you find the best deal for your gold coins.

Trading through Authorized Dealers

Authorized dealers provide a reliable and regulated channel for trading gold coins. These dealers have the necessary licenses and expertise to facilitate buying and selling transactions. Engaging with authorized dealers ensures a transparent and secure process, protecting both buyers and sellers.

Redeeming Gold Coins for Cash

In some cases, redeeming gold coins for cash can be an attractive option for investors. This allows investors to convert their gold coins into liquid funds without the complexities and restrictions of exporting. It is essential to assess the prevailing market price and consider any associated fees or charges before opting for this alternative.

Import Regulations in Destination Countries

Researching Import Laws and Taxes

Before exporting gold coins to another country, it is crucial to research and understand the import laws and taxes of the destination country. Each country has its regulations, which may include import duties, taxes, or restrictions on certain types of gold coins. Familiarize yourself with these regulations to ensure a smooth import process.

Customs Procedures and Documentation

Understanding the customs procedures and documentation requirements of the destination country is essential. This includes completing the necessary paperwork accurately, providing the required certificates or licenses, and complying with any inspections or assessments upon arrival. Proper preparation and adherence to these procedures minimize the risk of delays or complications.

Engaging Professional Assistance

Navigating foreign import regulations can be complex, especially for individuals unfamiliar with the destination country’s legal framework. Engaging professional assistance, such as customs brokers or international trade consultants, can help ensure compliance with import regulations and streamline the process. Professional advice can save you time, effort, and potential pitfalls.

Considerations for Antique and Collectible Coins

Differentiation from Investment Gold Coins

Antique and collectible gold coins have distinct characteristics that differentiate them from investment gold coins. These coins may have historical or cultural significance, making their export subject to specific regulations and requirements. It is crucial to differentiate between investment and collectible coins to ensure compliance with the appropriate export regulations.

Appraisal and Certification

When exporting antique and collectible coins, proper appraisal and certification are essential. These coins often require specialized knowledge and expertise to determine their authenticity, value, and historical significance. Obtaining an appraisal from a reputable expert and acquiring the necessary certification ensures compliance with export regulations and establishes the credibility of your coins.

Special Export Considerations

Antique and collectible gold coins may have special considerations during the export process. These can include obtaining additional permits or clearances from relevant authorities, providing detailed documentation regarding the coins’ provenance, and complying with any cultural heritage or preservation laws. Thorough research and professional guidance are key to navigating these export considerations.

Conclusion

As a gold investor in Malaysia, understanding the regulations surrounding the export of gold coins is crucial. Compliance with these regulations ensures a legal and transparent process while protecting your investments. By staying informed, considering alternative options, and researching import regulations in destination countries, you can navigate the export process with confidence. Remember to engage with professionals when needed and always prioritize compliance to safeguard your reputation and future transactions.